- #Generally accepted accounting principles gaap full

- #Generally accepted accounting principles gaap free

Constraints govern the duties of an accountant in deciding to share or withhold information. Principles are guidelines that accountants follow in reporting transactions accurately. Assumptions are generally understood procedures that bookkeepers follow.

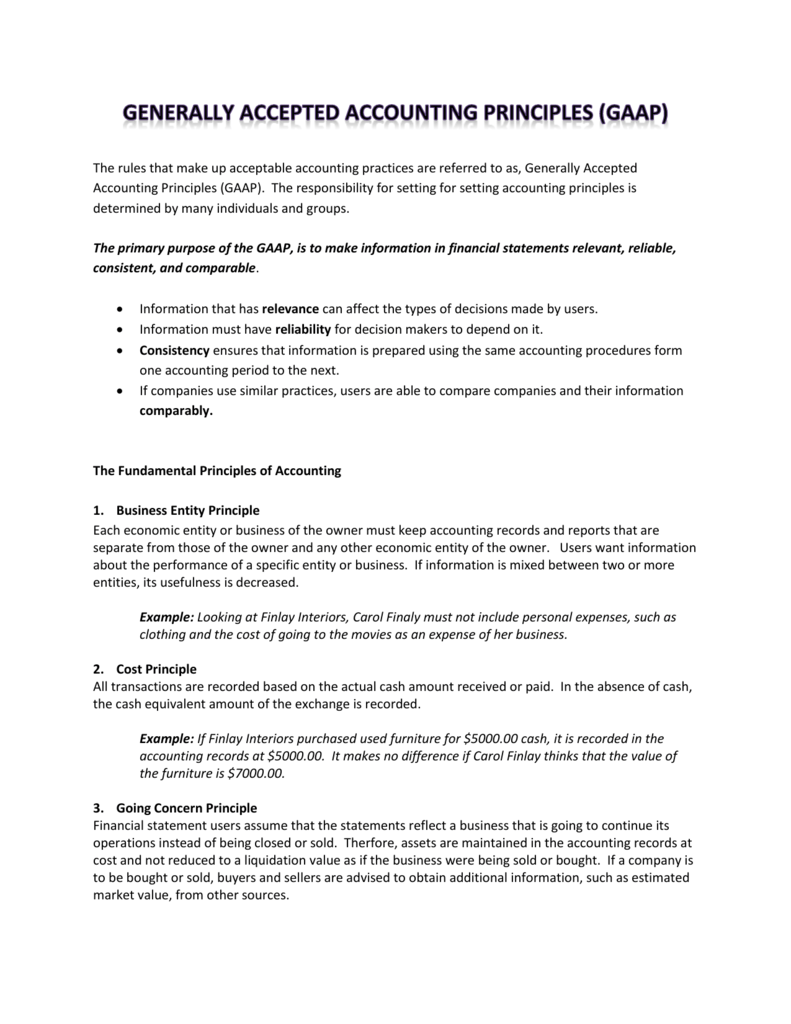

They're considered guidelines rather than rules because accountants use their own judgement to apply them according to the situation. Generally accepted accounting principles comprise a set of assumptions, principles, and constraints. GAAP assumptions, principles and constraints This can help reduce delays in recording sales, revenue, and other figures. For example, if a company makes a sale to a customer that uses a credit card, they record the transaction at the time it occurs, rather than when they receive a payment from the card issuer. This is in contrast to the cash basis method, which records a sale when there's an exchange of money. These principles follow accrual-based accounting, which states that you may record sales at the time that they occur. Companies that don't follow these principles in their bookkeeping might have difficulty securing a loan or issuing a public offering of shares.

#Generally accepted accounting principles gaap full

These standards help ensure every business reports transactions using the same method, and can allow investors to examine a company's financial records with full trust in the reported numbers. GAAP are the procedures that accountants follow when they record and report financial information. In this article, we explain what the generally accepted accounting principles are, provide a list of the key assumptions, principles, and constraints involved, explain the importance of these accounting principles, and consider their limitations. Learning about these principles can help you understand how businesses report financial transactions and the importance of clear rules in financial reporting. Generally accepted accounting principles, or GAAP, are the rules and standards that accountants follow when they record the finances of a business. For more information, please see our Privacy Policy Page.Accounting can allow businesses to track every aspect of their financial affairs and help ensure that they report all transactions accurately.

#Generally accepted accounting principles gaap free

Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers.

This can affect which services appear on our site and where we rank them.

While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. Our mission is to help consumers make informed purchase decisions. Clarify all fees and contract details before signing a contract or finalizing your purchase. For the most accurate information, please ask your customer service representative. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing.

0 kommentar(er)

0 kommentar(er)